|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

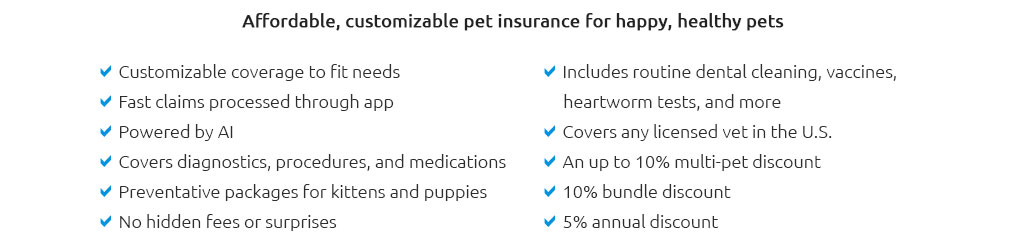

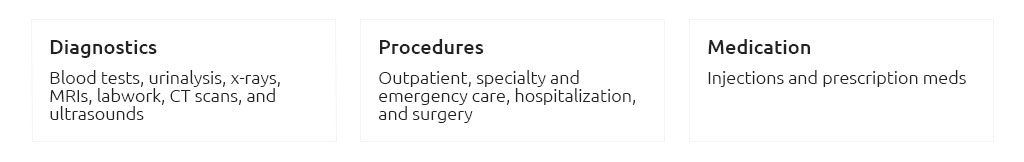

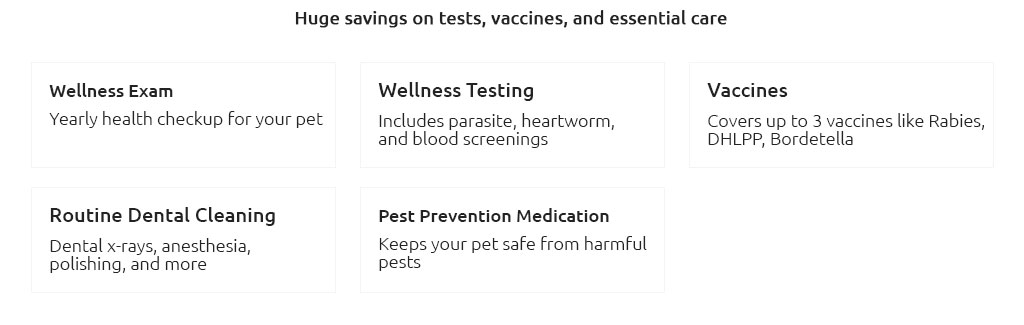

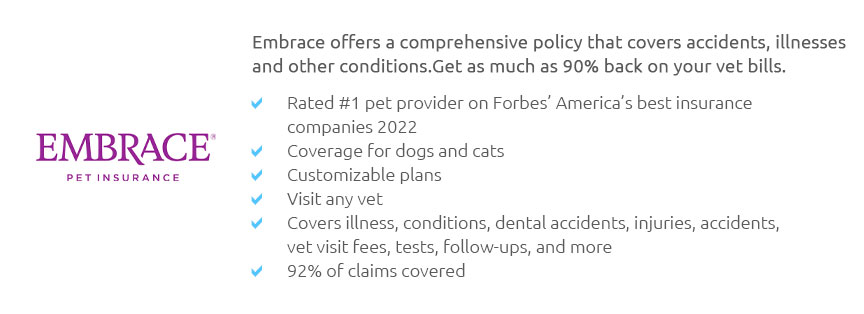

The Intricacies of Pet Medical Insurance for CatsIn today's ever-evolving world of pet care, pet medical insurance for cats has emerged as a pivotal consideration for many pet owners. With veterinary costs on the rise, safeguarding our feline companions' health through insurance is becoming increasingly important. However, choosing the right insurance can be a daunting task, requiring careful evaluation of various factors. Firstly, understanding the types of coverage available is crucial. Typically, pet insurance policies for cats encompass three main categories: accident-only, accident and illness, and comprehensive wellness plans. Accident-only policies, as the name suggests, cover injuries resulting from accidents. While these may seem appealing due to their lower premiums, they often fall short when faced with unexpected illnesses. On the other hand, accident and illness policies provide a more balanced approach, covering both injuries and illnesses, offering a peace of mind that many cat owners find invaluable. However, for those seeking a more inclusive option, comprehensive wellness plans are the ultimate choice. These not only cover accidents and illnesses but also routine check-ups, vaccinations, and preventive care. Choosing the right plan requires careful consideration of your cat's specific needs, age, and health status. Younger cats might benefit from accident and illness coverage, while older cats, prone to chronic conditions, may require the extensive coverage of a comprehensive plan. Additionally, consider factors such as deductibles, reimbursement levels, and any annual limits that might apply. One must also be vigilant about the policy's exclusions. Common exclusions often include pre-existing conditions, hereditary diseases, and elective procedures. Therefore, it's imperative to thoroughly scrutinize the policy details to avoid unforeseen surprises. Another critical aspect is the insurer's reputation. Researching customer reviews and ratings can provide valuable insights into the insurer's reliability and customer service quality. An insurer's willingness to settle claims promptly can significantly influence your overall experience. While some may argue that pet insurance is an unnecessary expense, the financial security it offers during emergencies is undeniable. It can transform a potentially devastating situation into a manageable one, ensuring that your beloved feline receives the best possible care without financial constraints. Ultimately, the decision to invest in pet medical insurance for your cat is a personal one, influenced by various factors unique to your situation. By weighing the pros and cons carefully, you can make an informed choice that aligns with your values and your cat's well-being. Frequently Asked QuestionsWhat is the best age to start insuring my cat? It's ideal to start insuring your cat while they are young and healthy, as pre-existing conditions typically aren't covered by insurance. Are hereditary conditions covered by pet insurance? Most basic policies do not cover hereditary conditions, but some comprehensive plans might offer this coverage. It's best to check the specifics of your policy. How do I choose the right deductible? Choosing the right deductible depends on your financial situation. A higher deductible usually means lower premiums, but more out-of-pocket expenses in the event of a claim. Can I insure an older cat? Yes, older cats can be insured, but premiums may be higher and coverage options more limited. It's beneficial to insure them early to avoid these issues. https://www.progressive.com/pet-insurance/

Pets Best offers an affordable, fixed-price pet insurance plan for broken bones, bite wounds, accidental swallowing of foreign objects, and other common ... https://www.petco.com/shop/en/petcostore/insurance

Two cats on our most popular plan would cost about $42/month. Electing coverage for four or more pets will increase your discount to 10%. Get a quote today. https://www.reddit.com/r/CatAdvice/comments/13drbpx/best_pet_insurance_for_cats/

I also have ASPCA pet insurance with good coverage for my cats who are indoor. ASPCA is quick and easy especially after the first claim and you ...

|